Using Charlie Munger's Mental Models in Investing

Unlock the secrets of Charlie Munger's mental models and discover how to avoid common psychological biases that can sabotage your investment decisions.

As value investors, we are likely familiar with the concept of mental models. Charlie Munger, Warren Buffett's long-time partner, has long championed the use of these cognitive tools to enhance decision-making and problem-solving. By drawing on a multidisciplinary approach, Munger has developed a robust set of mental models that inform his investment decisions and life philosophy.

The Limitations of Specialisation

We have all been there - our education system encourages us to specialise in specific subjects, which is essential for professional success. However, this specialisation can also lead to a narrow perspective, causing us to view complex problems through the limited lens of our expertise.

This "man with a hammer" mentality can distort our understanding of the world, making us see only nails when the reality is far more complicated.

Charlie Munger's Interdisciplinary Approach

Munger's approach is a prime example of how to bridge this gap. By drawing on multiple disciplines, including physics, psychology, and microeconomics, he has developed a unique set of mental models that inform his decision-making.

“A multidisciplinary attitude is required if maturity is to be effective … You have to learn many things in such a way that they’re in a mental latticework in your head and you automatically use them the rest of your life.” - Charlie Munger

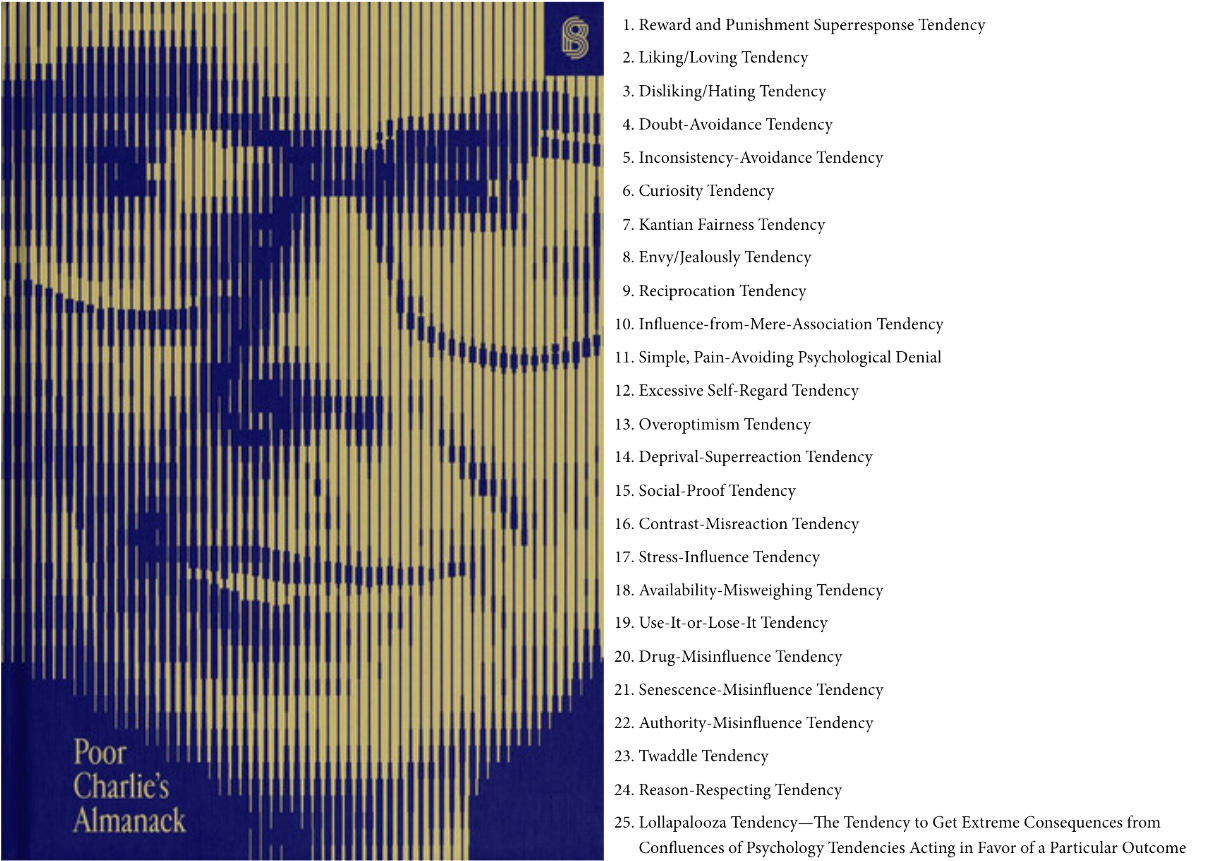

In his 1995 speech at Harvard University, "The Psychology of Human Misjudgment," Munger discussed various psychological tendencies that lead to poor decision-making and misjudgment. Charlie highlighted 25 psychological tendencies in his speech. His book, Poor Charlie's Almanack, is a highly recommended read for further insights.

Applying Munger's Insights to Investment Decisions

I have drawn inspiration from Munger's speech and incorporated his insights into my investment process. While mental models can be used to assess investment targets, they can also be used to evaluate ourselves.

To better avoid potential psychological misjudgments, we can use a checklist during the final stages of investment consideration. This checklist could help us increase our awareness and identify and mitigate any biases that may be influencing our decisions.

5 Mental Models to Avoid Our Own Psychological Errors

Today, I want to briefly go through the first five mental models from Munger's speech and share how we could apply them in our investment checklist process. Let's dive in!

1. Reward and Punishment Superresponse Tendency

Our behavior is significantly influenced by incentives due to the desire for rewards or fear of punishment. This concept draws upon the principles of operant conditioning, developed by B.F. Skinner, which posits that behaviors are modified through reinforcement or punishment, shaping the likelihood of those behaviors being repeated in the future.

Reflection Questions:

Are you being influenced by recommendations from others who may have incentive-bias in introducing this investment (like an advisor)?

Is your conditioned reflex pushing you to invest primarily because you want to make a quick speculative trading gain?

2. Liking/Loving Tendency

We tend to judge in favor of people and symbols we like, and ignore faults of, and comply with wishes of, the object of our affection.

Reflection Questions:

Are you judging in favor of the company because you like the tone or character of the CEO?

Are you ignoring the faults or weaknesses of the company due to your bias from liking?

3. Disliking/Hating Tendency

We tend to dislike people, products, and actions merely associated with the object of our dislike and ignore virtues in the object of dislike.

Reflection Questions:

Are you passing on this investment opportunity simply because you dislike the tone or the character of the CEO?

Are you ignoring what really matters?

4. Doubt-Avoidance Tendency

Our brain is programmed with a tendency to reach some decision as quickly as possible in order to eliminate uncertainty and discomfort associated with doubt, typically under stress or pressure.

Reflection Questions:

Have you actively looked for disconfirming evidence?

What are the conflicting information against your investment thesis?

Are you avoiding these disconfirming information to reach mental comfort?

5. Inconsistency-Avoidance (or Anti-Change) Tendency

Our brains conserve programming space by being reluctant to change and maintain our previous conclusions, human loyalties, reputational identity, commitments.

Reflection Questions:

Have you examined counterarguments to your own hypothesis, especially related to risk of permanent loss?

Assess what you have committed to (in terms of time and public comments) and how it is impacting your decision making.

Be aware that a quickly reached conclusion, triggered by doubt-avoidance tendency, when combined with a tendency to resist any change in that conclusion, will naturally cause a lot of errors in cognition for modern man. Are you falling into this trap?

By asking ourselves these reflection questions, we can better understand our own psychological biases and avoid making poor decisions.

Stay tuned for the next article, where we will explore more mental models and how to apply them to our investment decisions.